Break Even Analysis 1

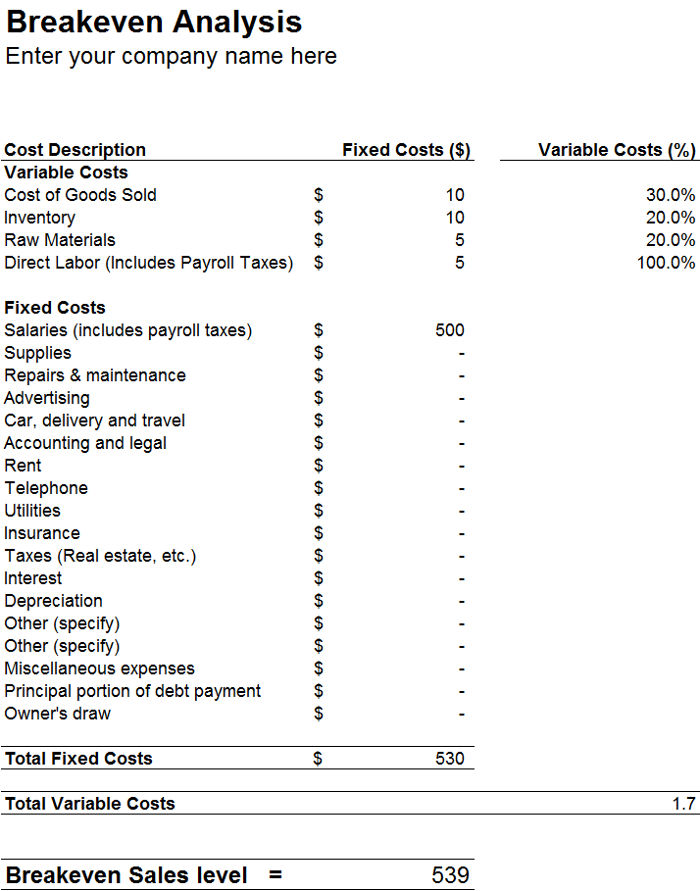

- File format: .xls

- After entering various fixed and variable costs to produce your product you will need to enter the sales price. The template then calculates the break even point.

- DOWNLOAD NOW

Our free break even analysis templates help you to determine your break even point

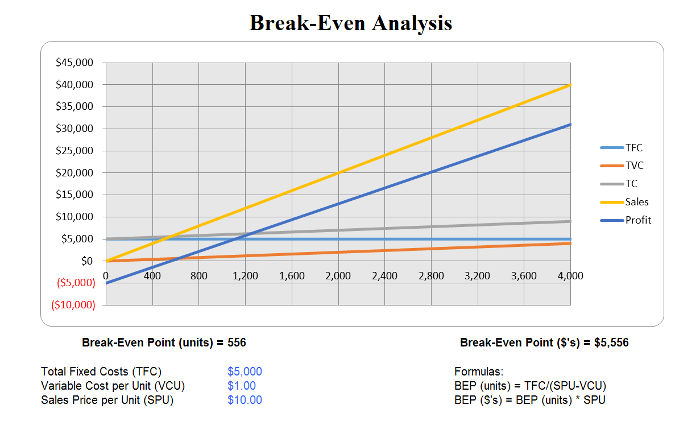

A break-even analysis (or break-even point) is a calculation that determines how much of a good or service needs to be sold in order to cover the total fixed costs.

It examines the margin of safety for a business based on the revenues earned from the normal business activities.

The break-even analysis determines the level of sales that the business must have, but it is a document intended only for internal usage. Therefore, it is not recommended to be provided to investors, regulators, and other financial institutions.

In a break-even analysis, the business owner will look at the fixed costs of the good or service relative to the profit that each additional good or unit of service will earn.

If your business has lower fixed costs, you will have a lower break-even point of sale. For example, if your fixed costs come to $5, then you will break even if your product sells for at least that amount.

However, the break-even analysis does not take into account the variable costs that are incurred for every good or unit of service sold. Therefore, while a $5 sales price in the example above will allow your product or service to break-even, your variable costs will still need to be taken into account.

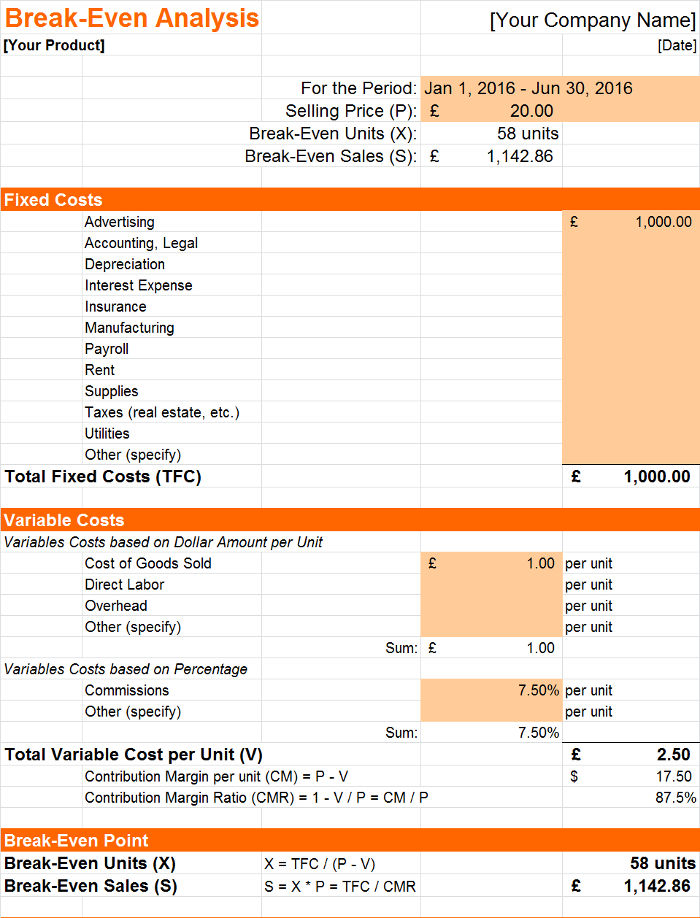

When we talk about the break-even analysis, we’re also dealing with the contribution margin. This margin is the difference between the price that the product is being sold for and the variable costs.

Therefore, if the total fixed costs for the product are $5 per product and the total variable costs are $12, and the product is sold for $30, the contribution margin will be $18 and the net profit will be $13.

You can calculate your break-even point analysis in one of two ways: units or dollars/sales.

For break-even analysis in units, you would simply divide your fixed costs by the sales per unit minus the variable cost per unit.

It would look like this: