What is a credit note and why should I use one?

A credit note, also known as a credit memo (or memorandum) is a commercial document that the seller issues to the buyer.

Instead of the document being a request for payment (as with an invoice), the credit note is actually a credit for the buyer for future purchases. The credit note would be issued for the same amount or a lower amount of the original invoice.

In that way, it can be seen as the opposite of an invoice. The reason why sellers would issue credit notes is because there has been some error in the original invoice or order.

This can include:

- the seller accidentally overcharging the buyer

- the seller failing to apply the correct discount rate

- the buyer received goods damaged during transit

- the buyer did not receive the goods

- the buyer received goods or services that did not meet quality standards

There can be other reasons for a seller issuing credit notes, but they often involve one of the five above-mentioned. There may also be multiple reasons for the seller issuing a credit note to the buyer, which should be included in the document.

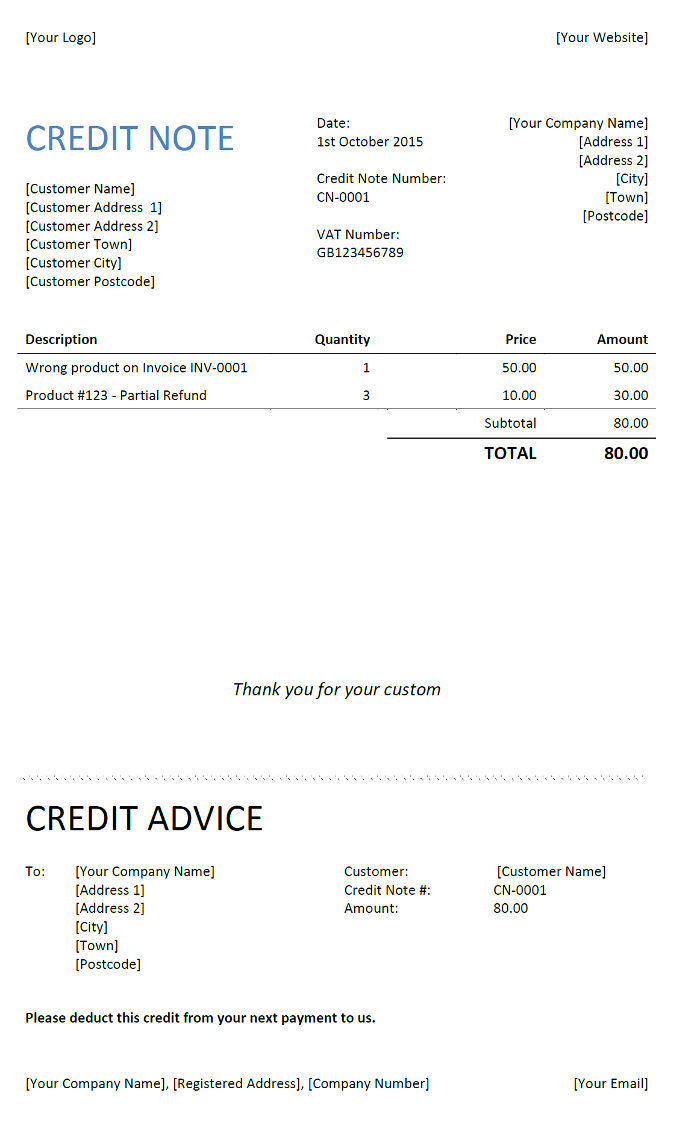

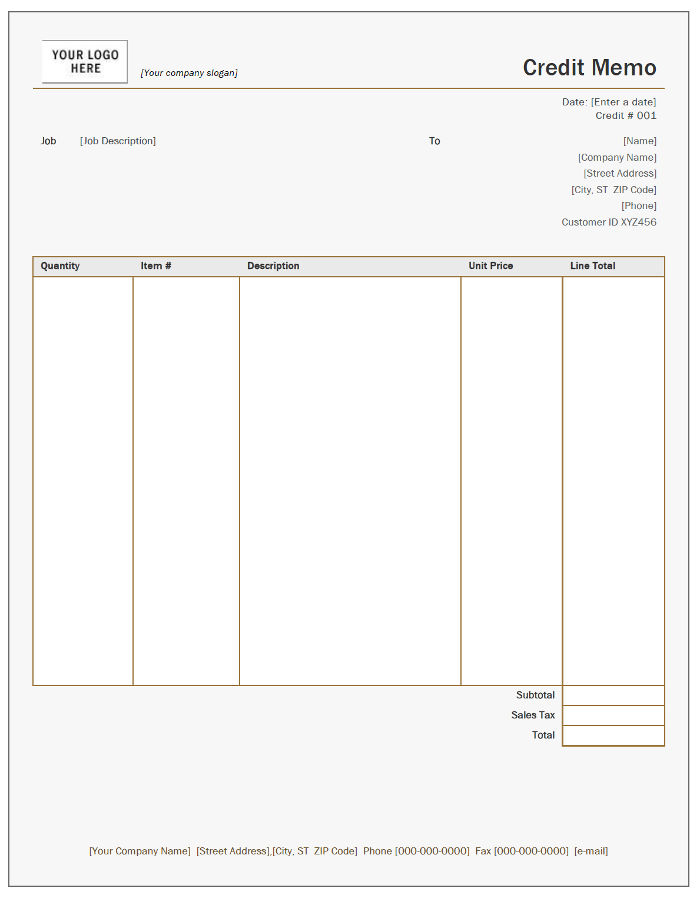

The credit note, similar to an invoice, will list the products, quantities and prices for the products that the buyer ordered. The credit is then applied to future invoices.

It should be noted, however, that the credit note is not a formal document. It specifically does not normally contain the PO #, billing and shipping addresses, terms of payment and other specific details. Therefore, the credit note is actually more of a note than a binding legal document.

Normally, the credit note will reference the original invoice and also state the reason for the credit note being issued.

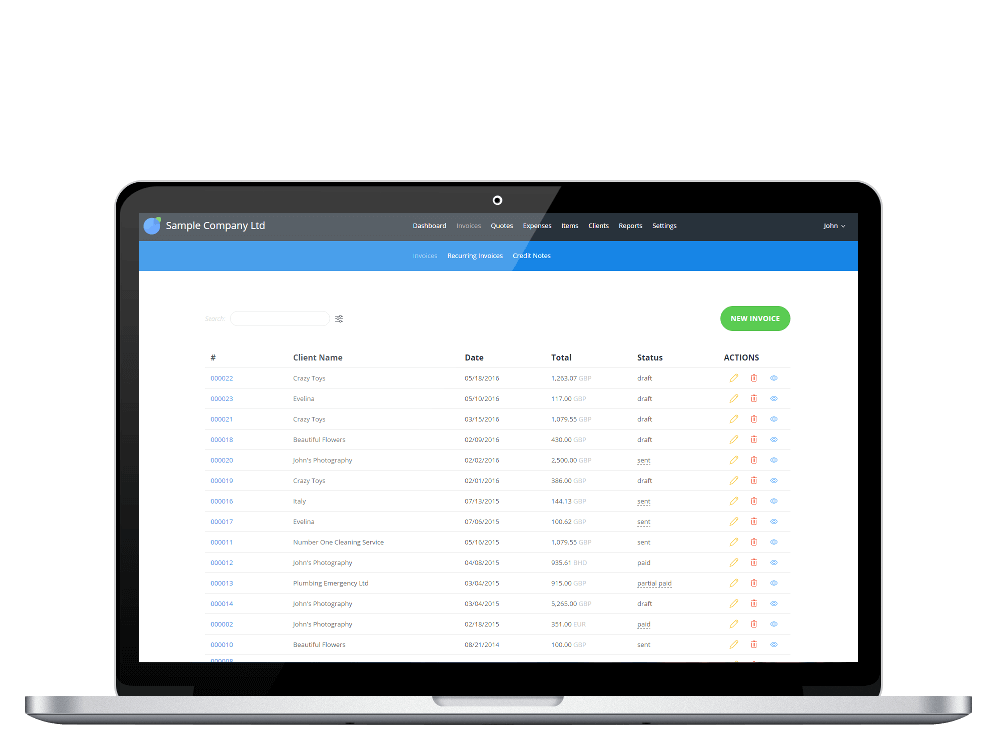

If you are involved in shipping goods to your clients, you may need to consider downloading our credit note templates. That way, you can have these documents at hand in case there are problems in the delivery of your goods.