What is a cash receipt?

If you receive cash from any source, such as a customer, you should provide that customer a cash receipt.

The reason for the customer or source giving you cash could be anything, such as:

- paying for goods or services

- paying for rent (for equipment or property)

- paying for interest received on investments

- funds the owner brought in to expand the business

When you have cash coming into your business, you need to record it, and the only way to do so would be to create a document—a cash receipt—for your accounting records. Two copies are made: one copy goes to the customer or other source, and the other cash receipt you keep.

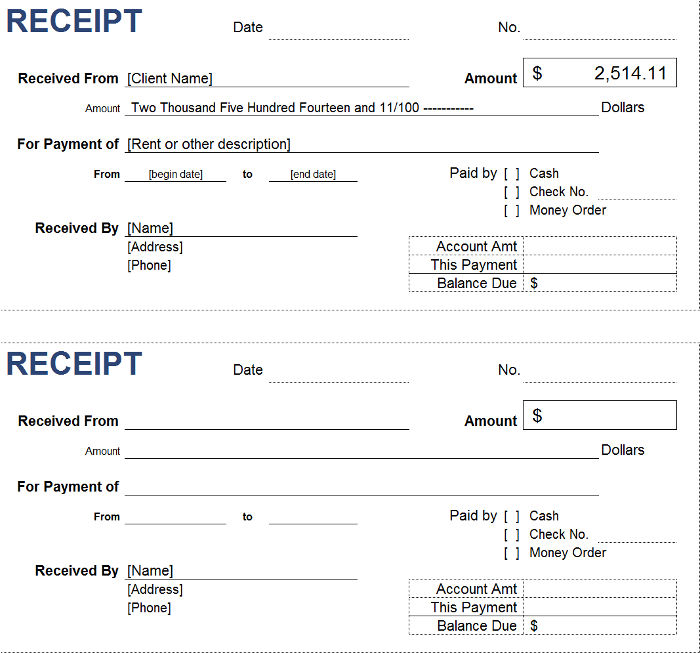

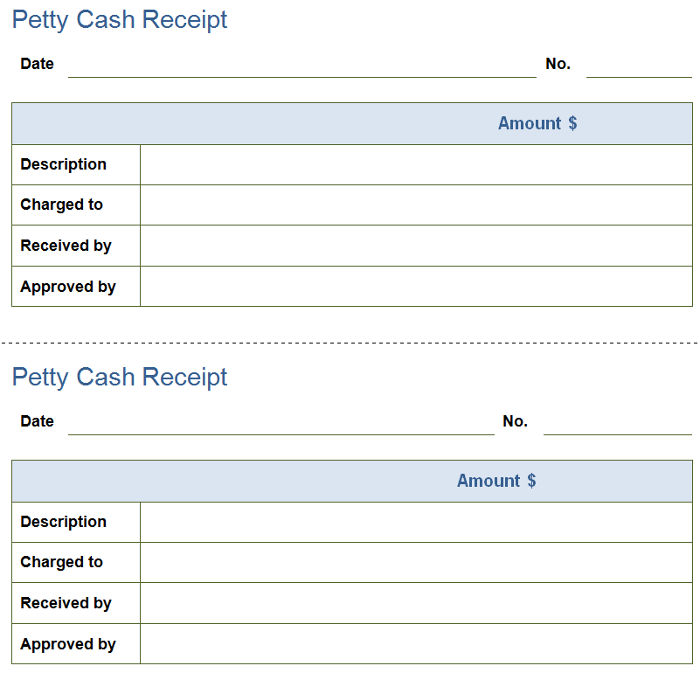

Cash receipts are very simple, small documents that are quick and easy to fill out. They include:

- the date

- the cash receipt number

- the name of the customer

- the amount

- the reason of payment

- the name of the person receiving the cash

- any balance due after receipt

It is very important to remember that if you are legally required to collect any sales tax or VAT from the payer, you will have to add this amount on to the receipt.

The collection of the sales tax or VAT will then be on behalf of your city, state, or national tax authority.

For this reason, in many countries it is mandatory for retailers to include this

sales tax or

VAT already in the display price of the goods or services.

It is important to remember also that

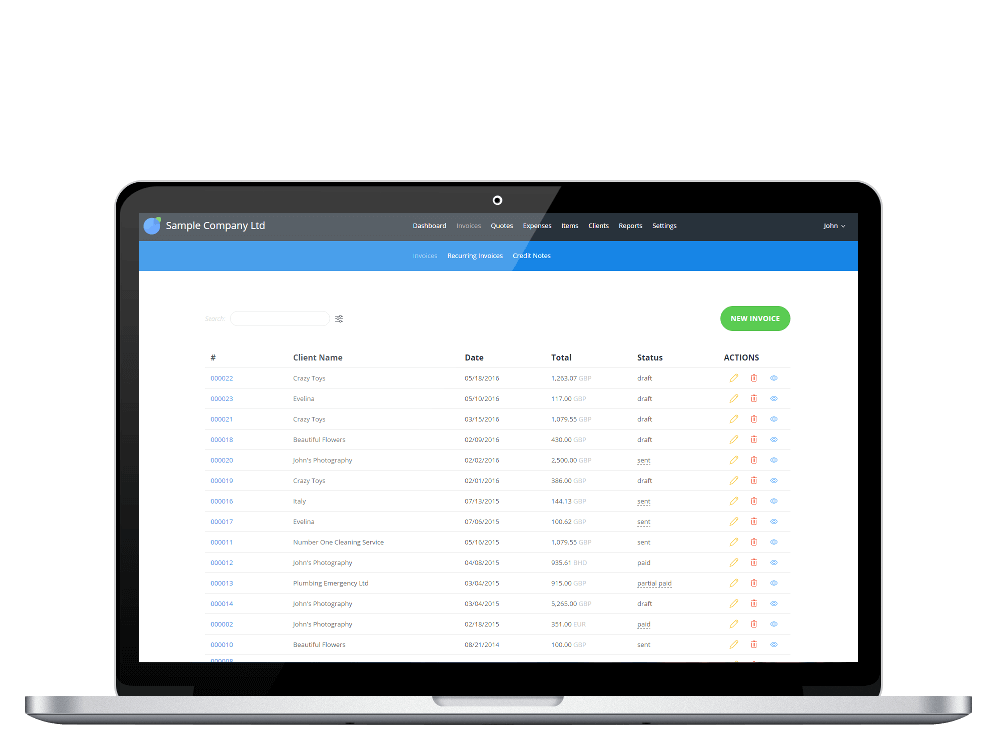

a receipt is not the same as an invoice. For one, an invoice is given by the seller to the buyer before any payment is made, while a receipt is given by the seller to the buyer after the payment is made.

Furthermore, an invoice is much more detailed than a cash receipt, often itemizing the list of goods or services purchased. Of course, there are certain receipts that offer this level of detail as well.